Mobile App Loan to M-Pesa in Minutes: Unsecured Loans in Kenya

More Kenyans depend on loans for survival, according to the Central Bank of Kenya and the Kenya National Bureau of Statistics, with 55% taking mobile app loans online.

More Kenyans depend on loans for survival, according to the Central Bank of Kenya and the Kenya National Bureau of Statistics, with 55% taking mobile app loans online.

Although the 2021 FinAccess Household Survey found that access to formal banking in Kenya increased to 83.7% due to technology uptake, most Kenyans cannot access formal credit facilities, forcing them to seek unsecured loans online.

Many bank account holders cannot qualify for a bank loan that requires proof of income, usually in the form of formal employment or fast-moving collateral security like a car title or land deed.

This situation has forced many Kenyans to seek alternative lending sources such as Chamas or table banking, friends and family, or lending merchants known as Shylocks.

However, these sources are usually unreliable and may fail to materialize when you need a loan urgently. Subsequently, most Kenyans have resorted to highly unregulated mobile and app loans for emergency borrowing, formally known as payday loans.

Interestingly, mobile app loan providers are amazingly fast at processing and disbursing funds, saving Kenyans from pressing emergencies and embarrassment. Subsequently, the fast loan to M-pesa slogan has become a popular selling point for most mobile app loans.

While mobile, apps, and online lenders are very efficient in disbursing borrowed cash, the efficiency comes at a cost.

Predatory lending by mobile app loan providers.

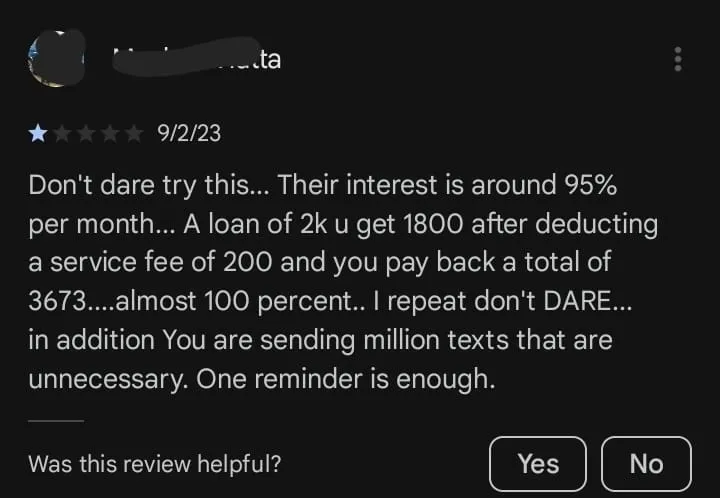

Some mobile loan providers exploit the desperation of online borrowers by charging exorbitant interest rates and loan processing fees.

Debt trap.

Some app and mobile lenders charge exorbitant interest rates, pushing many borrowers into a debt trap.

Some Kenyans borrow from one app to settle another loan on a different app and eventually fail to clear their loans since each subsequent loan increases the overdue amount through accruing interest, processing fees, and mobile transaction charges.

CRB blacklisting

Before the new regulations took effect, loan apps and mobile lenders could access borrowers’ credit files at the Credit Reference Bureau (CRB) and flag them for non-payment.

Subsequently, many borrowers who delayed or failed to repay their ballooning loans were blacklisted on lending apps and at the (CRB) preventing them from ever taking loans.

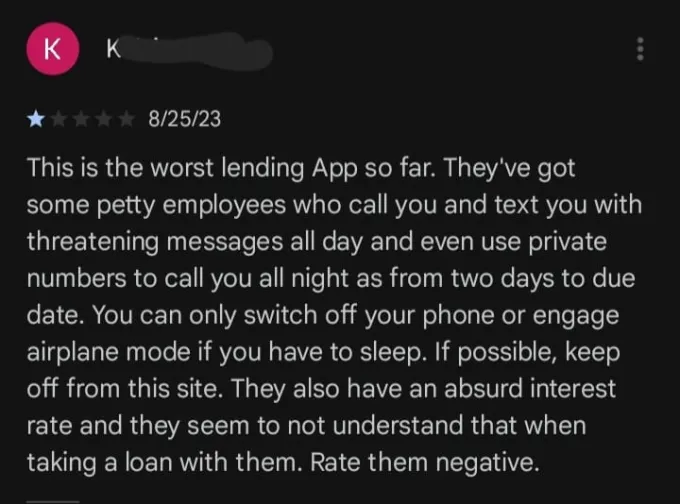

Unethical and embarrassing practices.

Loan apps have limited powers to enforce debt collection. Subsequently, some resorted to unethical practices such as embarrassing borrowers by calling their friends, family, colleagues, and acquaintances to force them to settle their debts.

However, the recently enacted Data Protection Act seeks to stop such practices by forcing lending apps to register as data processors and comply with privacy laws.

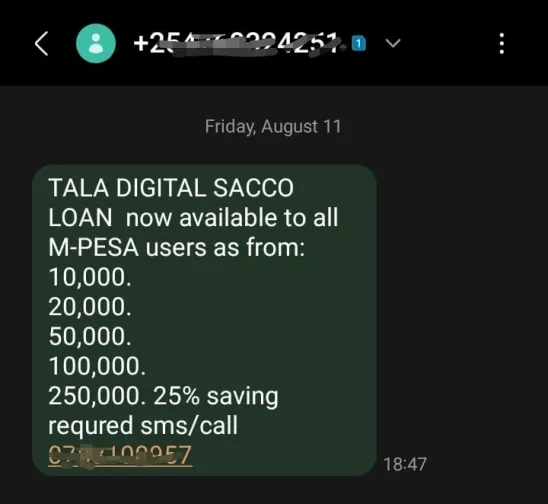

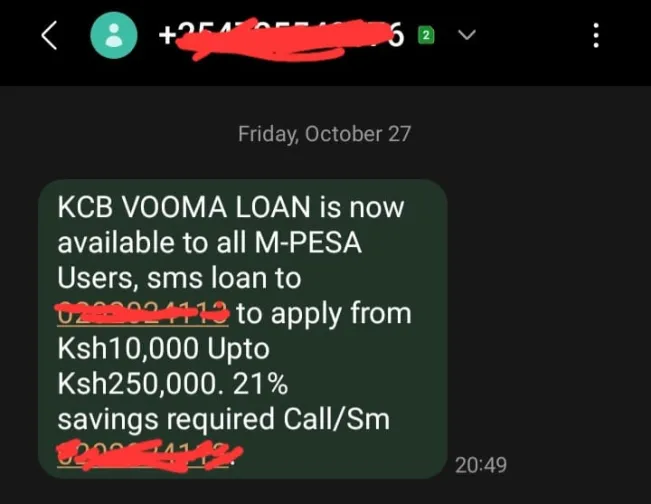

Online lending scams

Desperate borrowers regularly fall prey to fake loan apps in Kenya that demand upfront payment of interest and processing fees for a non-existent loan they will never receive.

Other scams include individuals promising to increase the Fuliza limit to allow borrowers to apply for bigger loans.

Other apps steal personal details for fraudulent purposes, such as impersonating individuals and applying for loans on their behalf, while others upload contacts and extort money from them.

Subsequently, Google Play Store has implemented additional requirements for lending apps to crack down on deceptive behavior.

Identifying fake loan apps is important to avoid falling prey victims to unscrupulous lenders and online scammers.

Poor user reviews and customer complaints

The easiest method of identifying fake lending apps is by reading user reviews online. Such apps usually have very few or poor ratings and are full of customer complaints about undisbursed funds and unethical practices.

Upfront fees for loan processing or interest payment.

Another indicator of deceptive behavior is demanding upfront fees for application processing or upfront interest payment. Such apps request money from the borrower to disburse funds, which does not make sense.

Irresistible deals.

Fake apps offer irresistible deals that are too good to be true, such as promising ksh. 50,000 unsecured loans for the first application without any proof of income or collateral.

While such an offer might be tempting for someone hard-pressed for cash, they usually are not practical.

Unsolicited loan offers.

Sometimes scammers will reach out to potential borrowers through SMS and promise them loans if they agree to pay a certain amount.

Fuliza limit increase.

People with low a Fuliza limit may be tricked by scammers promising to increase their borrowing limit. However, nobody except Safaricom can increase Fuliza limit, which usually depends on the transaction frequency and amount.

Branch Loan App - acquired Century Microfinance Bank to become Branch Microfinance Bank. The company is licensed to operate in Kenya with offices located on the 9th Floor of Reliable Towers, 11 Mogotio Road, Off Chiromo Lane, Westlands, Nairobi.

Tala loan app - A global lending app operating in Kenya, India, Mexico, and the Philippines. The app was founded by Shivani Siroya, who also acts as the CEO.

Zash Loan App - Rated 4.3 stars by 153,000 users with over 1 million users.

Zenka loan app - Rated 4.1 stars by 114,000 users on Google Play Store with over 5 million downloads.

Asap Cash - rated 4.4 stars by 75,000 users with over 1 million downloads.

Meta Loan - Rated 4.3 stars by 56,000 users with over 1 million downloaded on Google Play store.

FlashPesa - rated 4.5 stars by 11,000 users with over 1 million downloads.

Lend Plus - Rated 4.1 stars by 11,000 users with 1 million downloads.

FairKash - Rated 4.3 stars by 6,000 users with a total customer base of over 1 million.

The former Central Bank Governor Patrick Njoroge barred mobile lenders from accessing the CRB database to determine a borrower's creditworthiness.

Subsequently, all loan apps operating in the country do not check the borrowers' credit history.

Additionally, President William Ruto fulfilled his election promise to reinstate young people who had been blacklisted on the CRB for failing to pay loans from mobile lenders.

“We have made that commitment come true. Seven million Kenyans who were blacklisted in CRB all of them have been removed,” President Ruto said.

Subsequently, borrowers need not worry about their poor CRB rating when borrowing from mobile loan apps in Kenya.

However, loan apps still check M-Pesa transaction history to determine whether the borrower can repay the loans.

Banks, Saccos, and microfinance institutions have introduced app, mobile, and unsecured loan services targeting online borrowers.

The two most outstanding mobile loan providers are KCB Bank and Equity Bank. You can access the KCB mobile loan from the bank app or M-Pesa Menu.

Similarly, to access an unsecured loan from Equity Bank, download the Equity mobile app from Google Play Store or Apple App Store, dial short code *247# from your Safaricom line, or go to My Account on Equitel line and submit a loan request.

The advantage of taking unsecured loans with banks is that they are regulated by the Central Bank of Kenya and offer fixed interest rates with no hidden charges. Additionally, their interest rates are way lower compared to payday loans.

Other alternatives to mobile app loans in Kenya include:

Safaricom Fuliza - is an overdraft service that allows Safaricom customers to send mobile money without enough funds in their mobile money wallet. The loan facility is used to buy goods at shops, send money to relatives and family, and even top up airtime. Safaricom disclosed that Kenyans borrowed 20 billion in airtime within four months in 2023.

Airtel Money Loan - unknown to many, Airtel provides easy mobile loans to Airtel money users. If you have maxed out your Fuliza loan or want additional cash, you might want to check out Airtel Money.

Hustler Fund - Huster Fund is a Kenya Kwanza government initiative to allow Kenyans to access loans without collateral and grow their limit. Within four months of introduction, Kenyans borrowed Sh26 billion, repaid Sh16.25 billion, and saved Sh1.3 billion, according to government data.

Saccos - Saccos allow people to obtain loans using their shares as collateral and friends as guarantors

Chamas or Table banking - or Merry-go-round allows members to contribute to one recipient, providing a lumpsum that will be paid in through contribution to others.

Donations - Kenyas still depend on donations to settle emergencies such as hospital bills, burial expenses, school fees for needy students, or even rent and electricity tokens.

Hire purchase - Some loan providers offer physical goods such as mobile phones, TV sets, solar kits, cooking gas, and sofa sets on credit. Examples of such loan facilities include M-Kopa and lipa mdogo mdogo.